The banking industry has long been an integral part of the global economy, providing essential services such as deposit-taking, lending, and investment management. However, the industry has also been susceptible to crises, as evidenced by the events this 2023. This year alone, the banking world was rocked by a series of crises involving several prominent institutions, including SVB and Signature Bank in the United States, and Credit Suisse in Switzerland.

The crises were sparked by a range of factors, including weak risk management practices, exposure to high-risk assets, and inadequate regulatory oversight. As a result, these banks experienced significant losses, leading to financial instability and eroding public trust in the banking system.

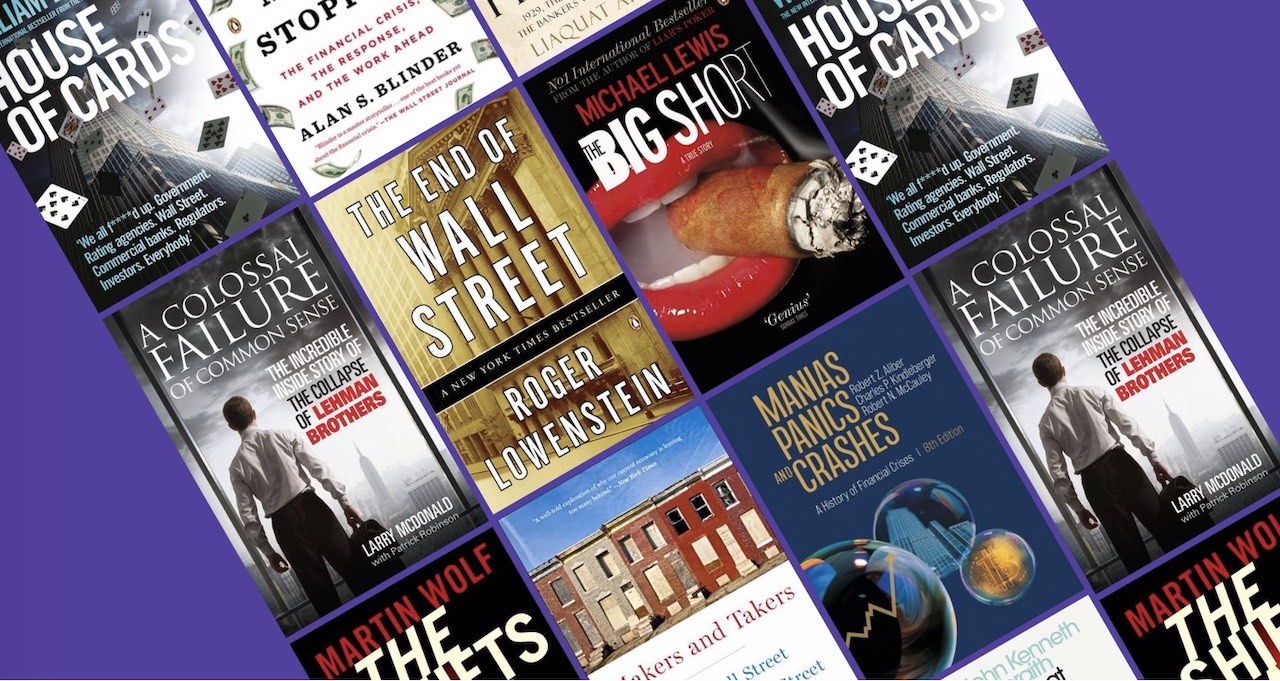

While these events were complex and multifaceted, a number of books have been written in recent years that provide valuable insights into the causes, consequences, and aftermath of these crises. In this article, we will explore some of the most informative and influential books on the banking and global financial crises, and highlight the key lessons that can be learned from these important works.

Too Big to Fail: Inside the Battle to Save Wall Street

By Andrew Ross Sorkin

They were masters of the financial universe, flying in private jets and raking in billions. They thought they were too big to fail. Yet they would bring the world to its knees.

Andrew Ross Sorkin, the news-breaking New York Times journalist, delivers the first true in-the-room account of the most powerful men and women at the eye of the financial storm – from reviled Lehman Brothers CEO Dick ‘the gorilla’ Fuld, to banking whiz Jamie Dimon, from bullish Treasury Secretary Hank Paulson to AIG’s Joseph Cassano, dubbed ‘The Man Who Crashed the World’.

Through unprecedented access to the key players, Sorkin meticulously re-creates frantic phone calls, foul-mouthed rows and white-knuckle panic, as Wall Street fought to save itself.

House of Cards: How Wall Street’s Gamblers Broke Capitalism

By William D. Cohan

From the author of The Last Tycoons, William D. Cohan’s international bestseller House of Cards: How Wall Street’s Gamblers Broke Capitalism dissects the collapse of Bear Stearns and the beginning of the financial crisis.

From our partners:

It was Wall Street’s toughest investment bank, taking risks where others feared to tread, run by testosterone-fuelled gamblers who hung a sign saying ‘let’s make nothing but money’ over the trading floor.

Yet in March 2008 the 85-year-old firm Bear Stearns was brought to its knees – and global economic meltdown began. With unprecedented access to the people at the eye of the financial storm, William Cohan tells the outrageous story of how Wall Street’s entire house of cards came crashing down.

A Colossal Failure of Common Sense: The Incredible Inside Story of the Collapse of Lehman Brothers

By Larry McDonald & Patrick Robinson

When Lehman Brothers bank went under, the world gasped. One of the world’s biggest and most successful banks, its downfall was the event that sparked the slide of the world economy toward a Great Depression II.

This is the gripping inside story of the dark characters who ruled Lehman, who refused to heed warnings that the company was headed for an iceberg; the world-class, mid-level people who valiantly fought to get Lehman off its disastrous course; the crash that didn’t have to happen. A news-breaking explanation that answers the question everyone still asks: “why did it happen?”

Larry McDonald, a former vice-president at Lehman Brothers in charge of distressed debt trading and convertible securities, was right at the centre of the meltdown of the company and gives an intimate look at the madhouse that Lehman became. This book shows beyond a doubt that Richard Fuld, the long-time CEO of Lehman, and his top executives, were totally out to lunch, allowing Lehman’s risk profile to reach gargantuan proportions.

While the traders, like Larry McDonald, clearly predicted more than two years in advance that the market for packaged subprime mortgages and credit default swaps would evaporate, the high-flying Lehman bosses pushed hard on the gas pedal until the very end.

The Shifts and the Shocks: What we’ve learned – and have still to learn – from the financial crisis

By Martin Wolf

There have been many books that have sought to explain the causes and courses of the financial and economic crisis which began in 2007-8. The Shifts and the Shocks is not another detailed history of the crisis, but the most persuasive and complete account yet published of what the crisis should teach us us about modern economies and economics.

The book identifies the origin of the crisis in the complex interaction between globalization, hugely destabilizing global imbalances and our dangerously fragile financial system. In the eurozone, these sources of instability were multiplied by the tragically defective architecture of the monetary union. It also shows how much of the orthodoxy that shaped monetary and financial policy before the crisis occurred was complacent and wrong. In doing so, it mercilessly reveals the failures of the financial, political and intellectual elites who ran the system.

The book also examines what has been done to reform the financial and monetary systems since the worst of the crisis passed. ‘Are we now on a sustainable course?’ Wolf asks. ‘The answer is no.’ He explains with great clarity why ‘further crises seem certain’ and why the management of the eurozone in particular ‘guarantees a huge political crisis at some point in the future.’ Wolf provides far more ambitious and comprehensive plans for reform than any currently being implemented.

Written with all the intellectual command and trenchant judgement that have made Martin Wolf one of the world’s most influential economic commentators, The Shifts and the Shocks matches impressive analysis with no-holds-barred criticism and persuasive prescription for a more stable future. It is a book no-one with an interest in global affairs will want to neglect.

House of Debt: How They (and You) Caused the Great Recession, & How We Can Prevent It from Happening Again

By Atif Mian & Amir Sufi

The Great American Recession resulted in the loss of eight million jobs between 2007 and 2009. More than four million homes were lost to foreclosures. Is it a coincidence that the United States witnessed a dramatic rise in household debt in the years before the recession – that the total amount of debt for American households doubled between 2000 and 2007 to $14 trillion? Definitely not.

Armed with clear and powerful evidence, Atif Mian and Amir Sufi in House of Debt reveal how the Great Recession and Great Depression, as well as the recent economic malaise in Europe, were caused by a large run up in household debt followed by a significantly large drop in household spending. Mian and Sufi argue strongly with real data that current policy that is too heavily biased toward protecting banks and creditors, with the goal of increasing the flow of credit, a response that is disastrously counterproductive when the fundamental problem is actually too much debt. Thoroughly grounded in compelling economic evidence, House of Debt offers convincing answers to some of the most important questions facing the modern economy today: Why do severe recessions happen? Could we have prevented the Great Recession and its consequences? And what actions are needed to prevent such crises going forward?

After the Music Stopped: The Financial Crisis, the Response, and the Work Ahead

By Alan S. Blinder

Alan S. Blinder-esteemed Princeton professor, Wall Street Journal columnist, and former vice chairman of the Federal Reserve Board under Alan Greenspan-is one of our wisest and most clear-eyed economic thinkers. In After the Music Stopped, he delivers a masterful narrative of how the worst economic crisis in postwar American history happened, what the government did to fight it, and what we must do to recover from it. With bracing clarity, Blinder chronicles the perfect storm of events beginning in 2007, from the bursting of the housing bubble to the implosion of the bond bubble, and how events in the U.S. spread throughout the interconnected global economy. Truly comprehensive and eminently readable, After the Music Stopped is the essential book about the financial crisis.

The End Of Wall Street

By Roger Lowenstein

The End of Wall Street is a blow-by-blow account of America’s biggest financial collapse since the Great Depression. Drawing on 180 interviews, including sit-downs with top government officials and Wall Street CEOs, Lowenstein tells, with grace, wit, and razor-sharp understanding, the full story of the end of Wall Street as we knew it. Displaying the qualities that made When Genius Failed a timeless classic of Wall Street-his sixth sense for narrative drama and his unmatched ability to tell complicated financial stories in ways that resonate with the ordinary reader- Roger Lowenstein weaves a financial, economic, and sociological thriller that indicts America for succumbing to the siren song of easy debt and speculative mortgages.

The End of Wall Street is rife with historical lessons and bursting with fast-paced action. Lowenstein introduces his story with precisely etched, laserlike profiles of Angelo Mozilo, the Johnny Appleseed of subprime mortgages who spreads toxic loans across the landscape like wild crabapples, and moves to a damning explication of how rating agencies helped gift wrap faulty loans in the guise of triple-A paper and a takedown of the academic formulas that-once again- proved the ruin of investors and banks. Lowenstein excels with a series of searing profiles of banking CEOs, such as the ferretlike Dick Fuld of Lehman and the bloodless Jamie Dimon of JP Morgan, and of government officials from the restless, deal-obsessed Hank Paulson and the overmatched Tim Geithner to the cerebral academic Ben Bernanke, who sought to avoid a repeat of the one crisis he spent a lifetime trying to understand-the Great Depression.

Finally, we come to understand the majesty of Lowenstein’s theme of liquidity and capital, which explains the origins of the crisis and that positions the collapse of 2008 as the greatest ever of Wall Street’s unlearned lessons. The End of Wall Street will be essential reading as we work to identify the lessons of the market failure.

Makers and Takers: How Wall Street Destroyed Main Street

By Rana Foroohar

In looking at the forces that shaped the 2016 presidential election, one thing is clear: much of the population believes that our economic system is rigged to enrich the privileged elites at the expense of hard-working Americans. This is a belief held equally on both sides of political spectrum, and it seems only to be gaining momentum.

A key reason, says Financial Times columnist Rana Foroohar, is the fact that Wall Street is no longer supporting Main Street businesses that create the jobs for the middle and working class. She draws on in-depth reporting and interviews at the highest rungs of business and government to show how the “financialization of America”—the phenomenon by which finance and its way of thinking have come to dominate every corner of business—is threatening the American Dream.

Now updated with new material explaining how our corrupted financial system propelled Donald Trump to power, Makers and Takers explores the confluence of forces that has led American businesses to favor balance-sheet engineering over the actual kind, greed over growth, and short-term profits over putting people to work. From the cozy relationship between Wall Street and Washington, to a tax code designed to benefit wealthy individuals and corporations, to forty years of bad policy decisions, she shows why so many Americans have lost trust in the system, and why it matters urgently to us all.

Through colorful stories of both “Takers,” those stifling job creation while lining their own pockets, and “Makers,” businesses serving the real economy, Foroohar shows how we can reverse these trends for a better path forward.

Crisis Economics: A Crash Course in the Future of Finance

By Nouriel Roubini & Stephen Mihm

In this myth-busting book Nouriel Roubini shows that everything we think about economics is wrong. Financial crises are not unpredictable ‘black swans’, but an inherent part of capitalism. Only by remaking our financial systems to acknowledge this, can we get out of the mess we’re in.

Will there be another recession, and if so what shape? When will the next bubble occur? What can we do about it? Here Roubini gives the answers, and lists his commandments for the future.

Lords of Finance: 1929, The Great Depression, and the Bankers who Broke the World

By Liaquat Ahamed

It is commonly believed that the Great Depression that began in 1929 resulted from a confluence of events beyond any one person’s or government’s control. In fact, as Liaquat Ahamed reveals, it was the decisions made by a small number of central bankers that were the primary cause of that economic meltdown, the effects of which set the stage for World War II and reverberated for decades. As we continue to grapple with economic turmoil, Lords of Finance is a potent reminder of the enormous impact that the decisions of central bankers can have, their fallibility, and the terrible human consequences that can result when they are wrong.

The Big Short: Inside the Doomsday Machine

By Michael Lewis

The real story of the crash began in bizarre feeder markets where the sun doesn’t shine and the SEC doesn’t dare, or bother, to tread: the bond and real estate derivative markets where geeks invent impenetrable securities to profit from the misery of lower- and middle-class Americans who can’t pay their debts. The smart people who understood what was or might be happening were paralyzed by hope and fear; in any case, they weren’t talking.

Michael Lewis creates a fresh, character-driven narrative brimming with indignation and dark humor, a fitting sequel to his #1 bestseller Liar’s Poker. Out of a handful of unlikely-really unlikely-heroes, Lewis fashions a story as compelling and unusual as any of his earlier bestsellers, proving yet again that he is the finest and funniest chronicler of our time.

Manias, Panics, and Crashes: A History of Financial Crises

By Robert Z. Aliber, Charles P. Kindleberger, & Robert N. McCauley

In the Eighth Edition of this classic text on the financial history of bubbles and crashes, Robert McCauley joins with Robert Aliber in building on Charles Kindleberger’s renowned work. McCauley draws on his central banking experience to introduce new chapters on cryptocurrency and the United States as the 21st Century global lender of last resort. He also updates the book’s coverage of the recent property bubble in China, as well as providing new perspectives on the US housing bubble of 2003-2006, and the Japanese bubble of the late 1980s. And he gives new attention to the social psychology that leads people to take the risk of investing in Ponzi schemes and asset price bubbles. For the first time in this revised and updated edition, figures highlight key points to ensure that today’s generation of finance and economic researchers, students, practitioners and policy-makers—as well as investors looking to avoid crashes—have access to this panoramic history of financial crisis.

The Great Crash 1929

By John Kenneth Galbraith

John Kenneth Galbraith’s now-classic account of the 1929 stock market collapse remains the definitive book on the most disastrous cycle of boom and bust in modern times.

Vividly depicting the causes, effects, aftermath and long-term consequences of financial meltdown, Galbraith also describes the people and the corporations who were affected by the catastrophe. With its depiction of the ‘gold-rush fantasy’ ingrained in America’s psychology, The Great Crash 1929 remains a penetrating study of human greed and folly.

This post contains affiliate links.