A new study shows how the largest cities in Asia and North America will power the worldwide economy in the coming decades.

The 21st century is shaping up to be the century of cities. Billions of people will stream into cities in the coming decades—the great majority of them into the rapidly developing cities of the Global South. Large cities will also power the growth of consumption and global markets over the next decade and a half, according to a new study from the McKinsey Global Institute.

While consumption has typically been tied to population growth, the study finds that just a quarter of global growth between 2015 and 2030 will come from a rise in the number of consumers. Instead, the great bulk of it will come from their increasing incomes and purchasing power.

Large cities will account for 81 percent of total consumption and 91 percent of consumption growth between 2015 and 2030, according to the study. Moreover, this growth will be incredibly concentrated and spiky. Just 100 cities will generate 45 percent of consumption growth, and just 32 of them will account for a quarter of the global total ($23 trillion) over this 15-year time span. The growth in urban consumption will be driven largely by a shift toward the consumption of services and amenities in cities, including growing expenditures for entertainment, restaurants, and travel.

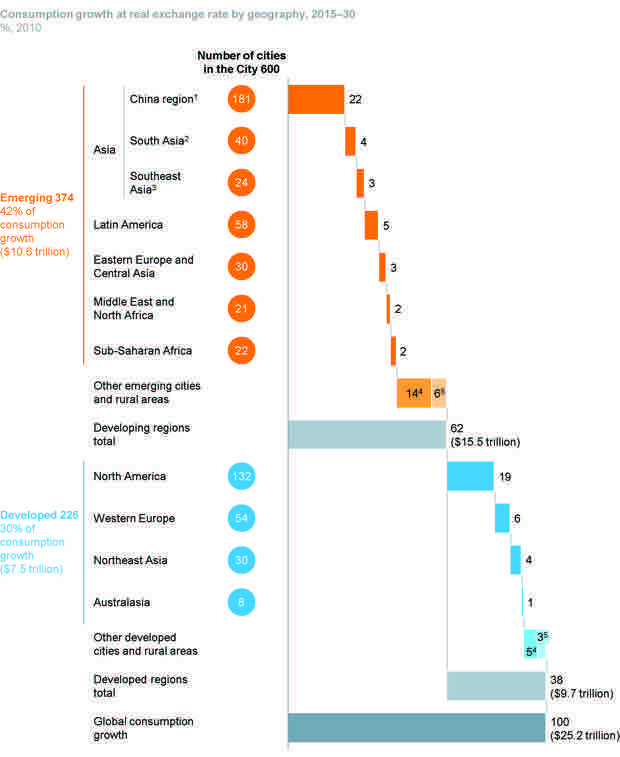

Between 2015 and 2030, roughly 42 percent of the growth in consumption, or more than $10 trillion, will come from 374 cities in the emerging economies of Asia, Latin America, Eastern Europe, the Middle East, and Africa, as the chart above shows. All together, more than half (56 percent) of consumption growth will come from emerging-market cities, according to the report. Another 30 percent of consumption growth, or $7.5 trillion, will come from 226 developed cities in North America, Western Europe, Australasia (which includes Australia, New Zealand, and New Guinea), and Northeast Asia.

From our partners:

This split reflects the uneven growth of cities in the Global North and South. On the one hand, urbanization is starting to plateau in advanced nations in the North. Western European cities in particular have been hit hard by population declines. More than two-thirds of these cities have shrinking populations, and include places such as Dublin, Lisbon, Madrid, and Palermo. Cities like Berlin, Milan, and Rio de Janeiro are projected to see less than one percent population growth from 2015-2025, as are Detroit and New York. On the other hand, consumption is exploding in the rapidly urbanizing areas of the Global South. Roughly 700 large cities in China alone are expected to fuel $7 trillion in urban consumption growth, or 30 percent of the global total, between 2015 and 2030.

The world’s leading consumer cities

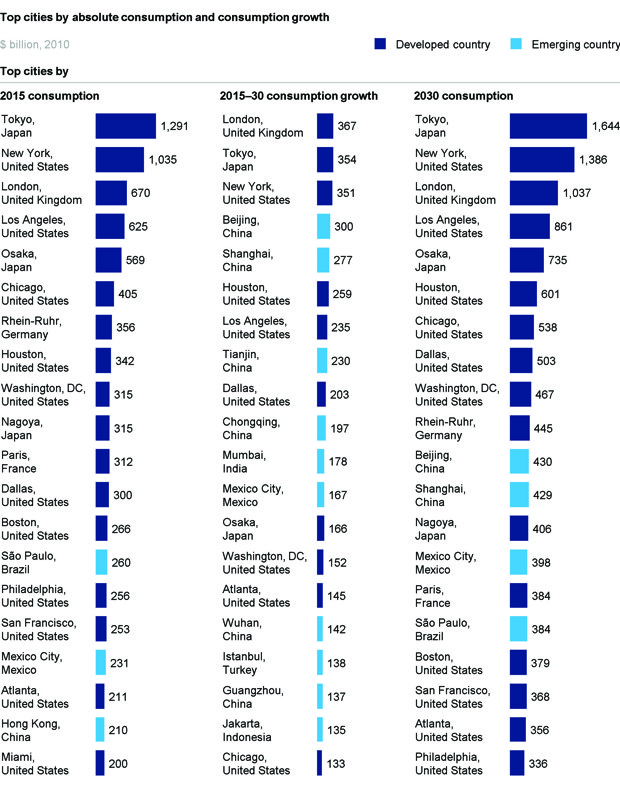

The chart below (from the McKinsey report) lists the cities where consumption is currently highest and where it is expected to grow most between 2015 and 2030.

Tokyo leads with around $1.3 trillion in consumption, followed by New York ($1 trillion*), London, ($670 billion), L.A. ($625 billion), and Osaka ($569 billion). Of the 20 metros with the largest consumption totals, 11 are in the U.S. and three are in Japan. The U.K., Germany, France, Brazil, Mexico, and China are each represented once on the list.

The top five metros with the largest projected growth in consumption are London ($367 billion), Tokyo ($354 billion), New York ($351 billion), Beijing ($300 billion), and Shanghai ($277 billion). Houston takes the sixth spot with $259 billion, followed by L.A. with $235 billion. Dallas is ninth, Washington, D.C., is 14th, Atlanta is 15th, and Chicago is 20th. Of the 20 cities with the largest predicted increase in consumption between 2015 and 2030, seven are located in the U.S., six are in China, and two are in Japan. The U.K., India, Mexico, Turkey, and Indonesia are each represented once.

A breakdown of U.S. cities

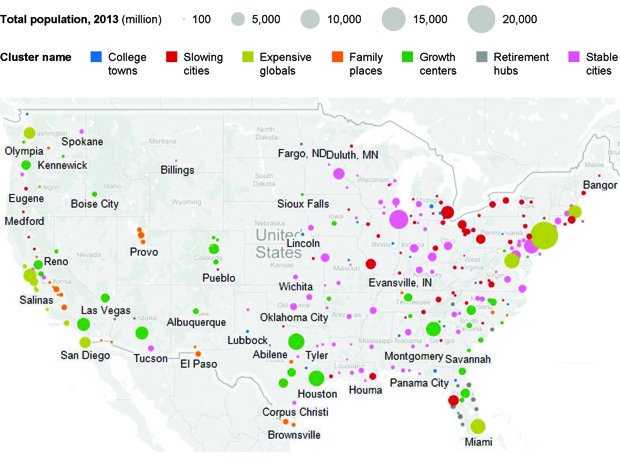

The map below provides an interesting breakdown of the types and patterns of consumption in U.S. cities.

Populations are growing in 40 so-called “Growth Centers” (shown in green)—including Atlanta, Charlotte, Dallas, Raleigh, and Nashville—through a combination of high birthrates, migration, and immigration, as well as low levels of unemployment. Populations are also increasing in “Retirement Hubs” (shown in grey and mainly located in Florida) and “Family Places” (shown in orange and mainly located in Texas, California, and Utah). “College towns” (in blue) are growing at about the same pace as the average large metro.

But, several places are seeing much slower growth among their populations. These include “Slowing Cities” (in red), which are mainly de-industrializing cities in and around the Rustbelt. ”Expansive Globals”—mainly large cities like New York, Miami, San Francisco, and San Diego (in yellow)—are also seeing below-average population growth, largely due to their high costs and geographic and land-use restrictions.

Top global consumers

The chart below breaks down the main types of consumers that are projected to drive the growth of urban consumption. Of these nine groups, the report notes that only three are a substantial force in reshaping global consumption. These are the retiring and the elderly (ages 60 and over) in developed countries, China’s working-age consumers (ages 15-59), and North America’s working-age consumers. All together, the study predicts that these three groups will generate an estimated $11 trillion—about half of global urban consumption from 2015-2030.

Over the coming decades, cities and urban areas will fuel the growth of consumption worldwide. But this consumption is increasingly concentrated in a small number of large and rapidly growing cities. The geography of consumption is becoming more and more spiky and uneven, reflecting and reinforcing the broader inequality of the global economy.

This feature originally appeared in Citylab.