We would like to thank our generous sponsors for making this article possible.

The music industry is on the cusp of another major structural change, according to Goldman Sachs Research. While the industry is yet to fully monetize its content, with music streaming services seeing less revenue for every song streamed, our analysts expect the sector to grow and capture new business opportunities.

Global revenue for recorded music is forecast to grow 7.5% in 2023 (versus 7.3% in the previous forecast), with a compound annual growth rate of 8.6% for 2023 to 2030 (broadly unchanged from before), Lisa Yang, head of the European Media and Internet Research team, writes in the team’s report. Goldman Sachs Research expects streaming growth to remain healthy, with a CAGR of 11% (unchanged).

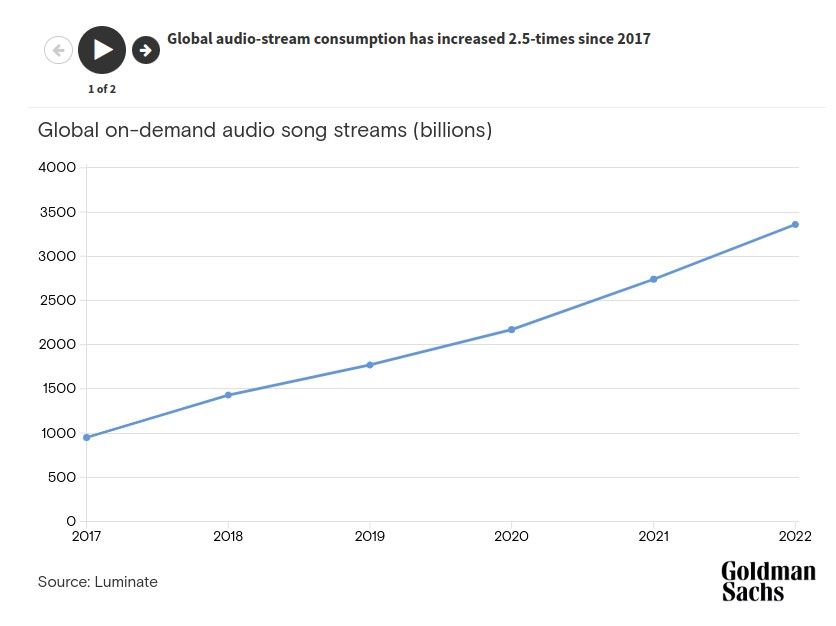

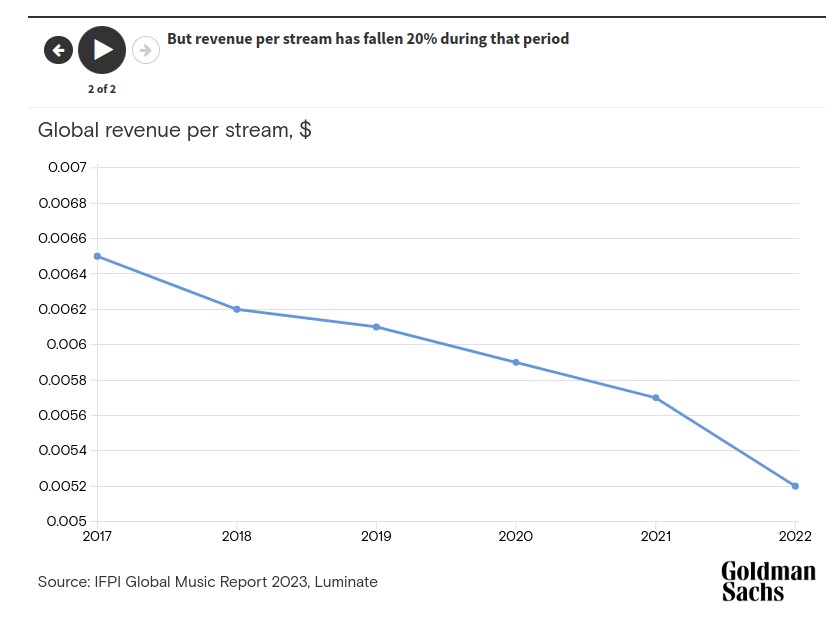

As barriers to the creation and distribution of music have fallen, the number of songs released onto streaming platforms has soared. The consumption of music streams has increased by 2.5 times since 2017. That would be great news for the labels if not for the fact that revenue per stream has fallen by 20% over the same time span.

Music revenue, meanwhile, as a percentage of what people spend on entertainment is today well below the level in 1998.

From our partners:

Another way to look at the issue: the average revenue per user (ARPU) on paid streaming music services has fallen by 40% since 2016. The decline in ARPU has occurred as streaming services such as Apple Music and Spotify have introduced family plans, lowering prices for bundled users.

A key question is how this tension between consumption and pricing is likely to play out going forward.

The early evidence suggests the streaming platforms might have more pricing power than they have demonstrated in prior years. Recently, several major music streaming platforms have pushed through price increases on their standard services for the first time in a decade. Conversations with industry figures suggest that those price increases have had negligible impact or no impact on churn for the platforms, according to Goldman Sachs Research.

“We believe that such price increases are not just a one-off, and we would expect the industry to work towards implementing price increases on a recurring basis, especially in an environment of higher inflation,” Yang writes in the team’s report.

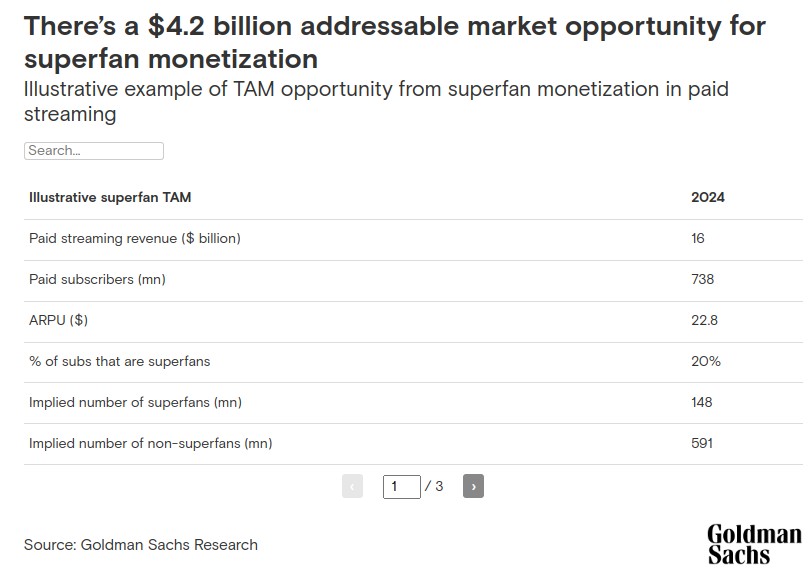

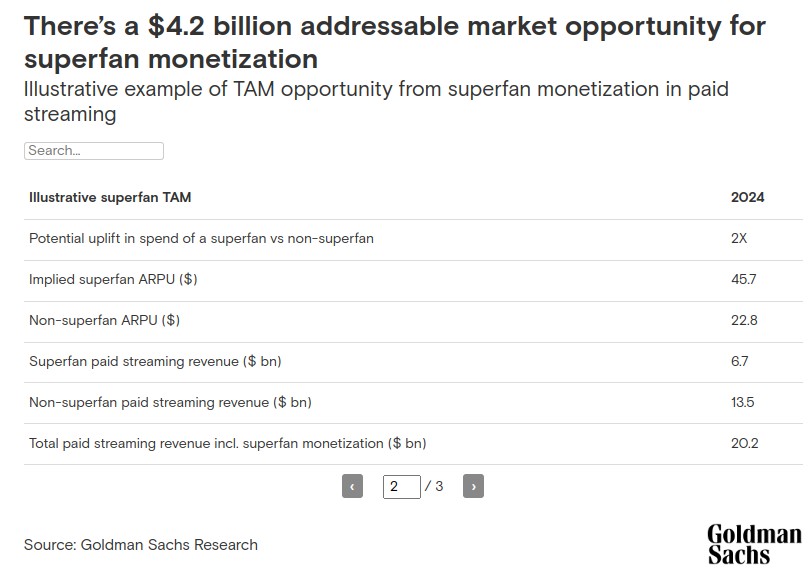

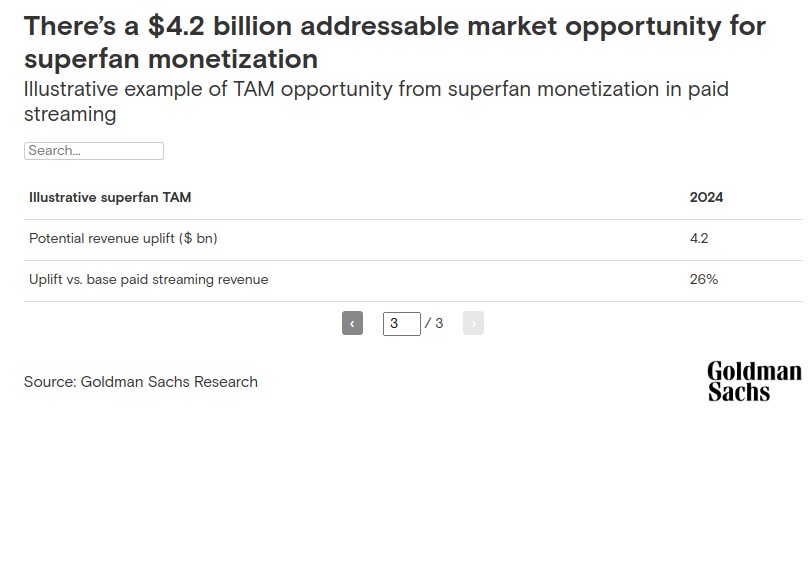

Another way to boost revenue may come from “superfan segmentation” — which could be a $4 billion opportunity. The current streaming model doesn’t distinguish among users, charging each the same flat monthly fee. This fails to recognize the different levels of engagement customers have with streaming platforms and artists — neglecting the value that may be created by a specific artist or song.

There should be strong appetite from superfans for the opportunity to lean closer to their favorite artists through their streaming platform, according to Goldman Sachs Research. Still, it may take time, and a number of iterations, to find the right new product offering to make this approach successful.

The team projects that monetization of superfans could add $2 billion of incremental revenue for streaming platforms by 2027 and $4 billion by 2030, representing a 16% boost to paid streaming revenues.

The inability to distinguish premium content is one of the reasons that the structure of payments between streaming services and music labels may be in need of change. The economic model for these payments hasn’t changed since 2008, when music streaming was just beginning.

Labels are paid “pro rata” based on the share of overall streams by all users for their artists. Each stream over 30 seconds in length counts equally in market share calculations. This means that the higher value that a customer might put on a new hit song or some other piece of content is not recognized.

“Listening to a 31-second song by an independent artist, a full 3-minute song by a popular artist, and 5 minutes of the sound of rain are all treated equally,” Yang writes. This differs from video streaming, where certain content is more highly valued and accordingly costs much more. Sports channels tend to command a higher subscription price, for example.

There are other issues with the current economic model as well. A system that incentivizes artists based on the number of streams played may lead to fraud and manipulation. Goldman Sachs Research estimates that a low single digit percentage of the royalty pool is lost each year to streaming fraud. There’s also an incentive for playlist algorithms to steer toward lower royalty content.

There are signs that industry leaders are ready to look closely at the issue and try out new approaches, Yang writes. One option is a user-centric model that might distribute payouts from each user’s subscription based directly on the user’s listening habits. An alternative is a more flexible artist-centric model that seeks to distribute payouts based on the value an artist creates and provides for the platform. For the first time in a long time, a conversation about new streaming payment models may be starting, she adds.

This article is being provided for educational purposes only. The information contained in this article does not constitute a recommendation from any Goldman Sachs entity to the recipient, and Goldman Sachs is not providing any financial, economic, legal, investment, accounting, or tax advice through this article or to its recipient. Neither Goldman Sachs nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the statements or any information contained in this article and any liability therefore (including in respect of direct, indirect, or consequential loss or damage) is expressly disclaimed.

Originally published at: Goldman Sachs