They’re not all based in New York and San Francisco.

Most mayors, economic developers, and researchers tend to lump high-tech industries together into a single large entity. But the truth is that different high-tech industries like software, information technology, and media are clustered in different areas of the country.

That’s the big takeaway from a new study I conducted with my colleague Karen King and the Martin Prosperity Institute, which is part of our ongoing research on the new geography of high-tech startup activity and venture capital investment worldwide and in the U.S. To get at this, we use detailed data from Thomson Reuters to identify the leading metros and ZIP codes with the largest clusters of venture capital investment and startup activity across five leading industries—software, IT services, biotechnology, medical devices and equipment, and media and entertainment. These five industries account for $25 billion, or more than three-quarters, of all venture capital investment.

The map and table below show the geography of venture capital investment in software startups. Unsurprisingly, the software industry makes up the largest share of venture capital (nearly $12 billion, or over 36 percent). The Bay Area dominates here, with $5.7 billion, or nearly half (47.9 percent), of this investment. $3.3 billion (or 27.6 percent of the total) comes from San Francisco, followed by San Jose (Silicon Valley), with $2.4 billion (or 20.2 percent). New York is third, with $978 million (8.2 percent), just ahead of Boston, with $907 million (7.6 percent). Rounding out the top 10 metros are L.A., Washington, D.C., Atlanta, Seattle, Austin, and Miami. Taken as a whole, the Boston-New York-Washington Corridor accounts for nearly a quarter (23 percent) of venture capital investment in software. Together, the top 10 metros account for over 80 percent.

From our partners:

Leading Metros for Software Investment

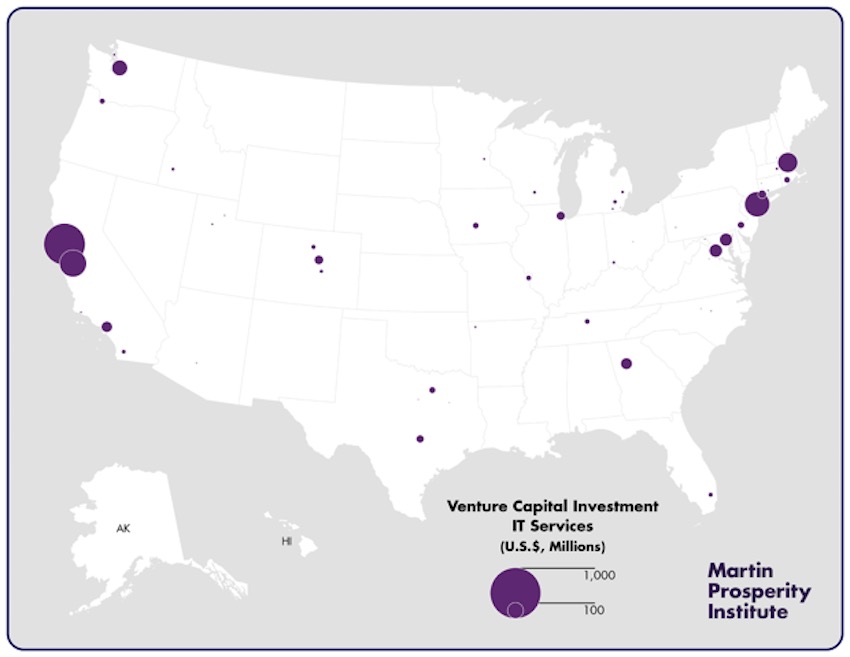

The geography of venture capital investment in information technology is similar to that for software. Again, San Francisco tops the list, with $666 million, or roughly a third (33.5 percent) of total investment. San Jose is a distant second, with $283 million, or 14.2 percent. New York follows closely with $246 million (12.4 percent), and Boston is fourth, with $156 million (7.9 percent). But smaller clusters can also be found in and around Seattle, Washington, D.C., Baltimore, Atlanta, L.A., and Denver. All together, the top 10 metros account for 86 percent of investment in information technology services. The San Francisco Bay Area accounts for nearly half (47.7 percent) of information technology investment, while the Boston-Washington Corridor accounts for another 30 percent.

Leading Metros for IT Services Investment

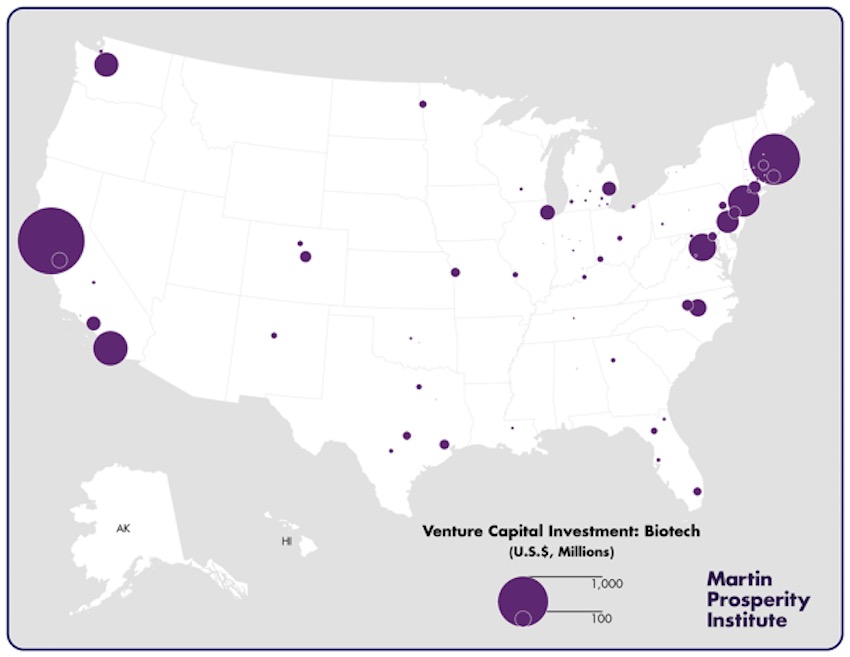

The geography of biotech is somewhat different. The Bay Area still dominates, but not to the extent that it did with software or information technology. Most of this investment comes from San Francisco, which accounts for roughly 30 percent of biotech investment, or $1.8 billion. Boston is now second, with $1 billion (18.1 percent), followed by San Diego ($477 million or 8.3 percent), New York ($407 million or 7.1 percent), and Washington, D.C. ($310 million or 5.4 percent). Rounding out the top 10 are Seattle, Philadelphia, Raleigh, Chicago, and—finally—San Jose, with less than two percent of venture investment in biotech. This geography can be explained by the fact that biotech startups are largely clustered around leading biotech universities, like the University of California San Francisco, MIT, and the University of San Diego. The Boston-Washington Corridor accounts for 40 percent of biotech investment, compared to less than a third for the San Francisco Bay Area. Together, the top 10 metros account for more than 80 percent of biotech investment.

Leading Metros for Biotech Investment

The geography of the biomedical industry (which includes medical devices and equipment) is similar to biotech. But now Boston bests San Francisco, with $370 million (or 15.8 percent of the total investment). San Francisco is second, with $366 million (15.6 percent), followed by San Jose, with $228 million (9.7 percent), and Los Angeles, with $216 million (9.2 percent). Other leading centers include Minneapolis-Saint Paul, San Diego, New York, Raleigh in the North Carolina Research Triangle, Atlanta, and Cleveland, largely due to the cluster surrounding the world-renowned Cleveland Clinic. Here, the Bay Area accounts for 27 percent of investment and the Boston-Washington Corridor accounts for 23 percent. Together, the top 10 metros account nearly three-quarters (72.6 percent) of all investment in biomedical devices.

Leading Metros for Biomedical Investment

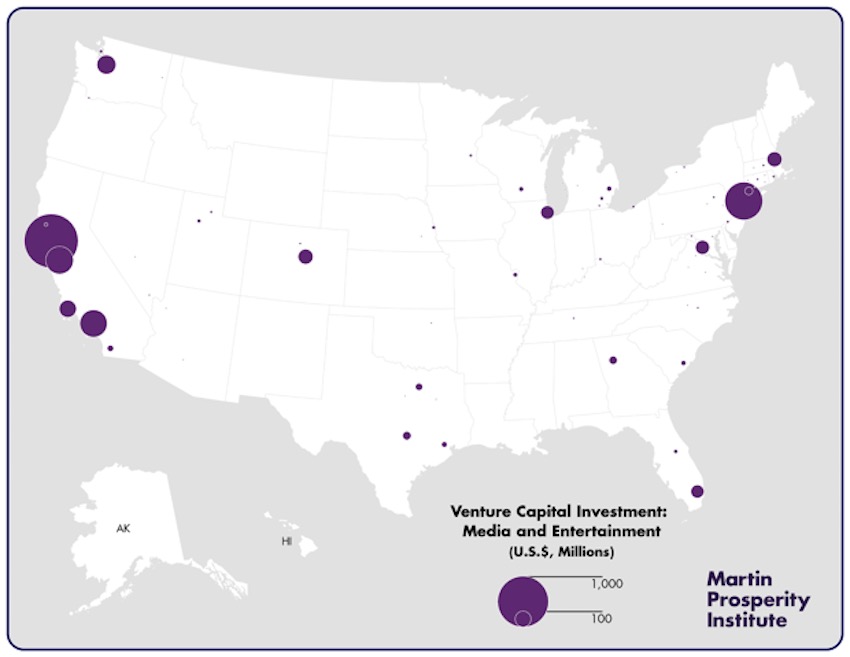

When it comes to media and entertainment, San Francisco tops the list with $1.1 billion, or nearly 36 percent of all investment, followed by New York, with $556 million (17.6 percent). San Jose and Los Angeles are next, each with $294 million or 9.3 percent. Together, the top 10 metros account for $2.8 million, or more than 90 percent of all venture capital investment in media and entertainment. Smaller clusters also appear in Seattle, Santa Barbara, Boston, Denver, Washington, D.C., and Chicago. The top 10 metros account for $2.8 billion, or more than 90 percent of all investment in media and entertainment.

Leading Metros for Media and Entertainment Investment

Several things stand out when looking at the geography of venture capital investment across these five leading industries. First, the Bay Area and the Boston-Washington Corridor dominate across the board. Another trend worth noting is the rise of San Francisco, which consistently bests Silicon Valley and leads in four out of five industries. The rise of New York is also significant, since the city had little venture capital investment a decade or two ago. On the East Coast, New York does especially well in media and entertainment, while Boston leads in biomedical devices. While investment in software, information technology, and media and entertainment has gravitated out of the suburbs of Silicon Valley and into the urban districts of San Francisco and New York, biotech and biomedical startups are located near leading universities.

All in all, the geography of high-tech industries is not a single pattern, but is instead made up of several different geographies. This is something mayors, federal policymakers, and economic developers should keep in mind as they look to cultivate these industries and clusters of innovation.

This feature originally appeared in Citylab.