We would like to thank our generous sponsors for making this article possible.

Increased activity in U.S. housing next year should bring opportunity for ESG investors, as the transition to more environmentally friendly home construction and renovation gathers pace.

The U.S. housing market appears headed for a recovery after years of volatility, as the compounding pressures of high interest rates, steep prices and scarce supply are expected to ease. New-home construction is forecast to rise 2% in 2024, while the home-improvement market should grow in 2024 and 2025 after a challenging 2023.

Morgan Stanley Research is anticipating structural changes in affordability, supply and financing in the next housing cycle. This could provide particular opportunity for sustainable investing in the housing market as demand for green home construction and renovation is expected to coincide with the U.S. housing market recovery, says equity strategist Michelle Weaver.

“Environmentally conscious consumers, government financial incentives and—in some cases—the declining cost of clean technologies should all drive growth in sustainable housing investing as the broader housing market picks up steam,” says equity strategist Michelle Weaver.

From our partners:

Incentives to Go Green

The U.S. government is expected to continue playing a significant role in supporting environmentally friendly solutions and technologies, and developing local supply chains as the transition to greener homes gathers pace. For instance, the Inflation Reduction Act and the Infrastructure Investment and Jobs Act included various tax credits, loans and grants to improve the energy efficiency and climate resiliency of residential buildings.

“These incentives don’t just benefit builders, developers and homeowners, they also bode well for shareholders of companies that manufacture and/or install energy-efficient and smart equipment, green building materials and clean technology for the home, as they boost demand by improving the economics of the green products,” says Laura Sanchez, head of sustainability equity research for the Americas.

Room for Improvement

Homeowners may also see a cost benefit from investment in green projects—but they need to be selective. Some projects pay off in the short to medium term, while others come with higher financial costs that may be difficult to recoup.

The shift to clean technologies used in onsite power generation, such as solar panels, stationary batteries and electric vehicle chargers, should bring down homeowners’ energy prices right away—especially in states such as California, where utility costs are high and rising.

Contracts with solar power companies, for instance, can yield savings immediately, since homeowners lease solar panels without any upfront costs and pay a monthly bill that typically works out to be cheaper than traditional utilities. These cost savings should help bolster the solar market, which Morgan Stanley Research analysts predict to grow from around $20 billion in 2024 to more than $30 billion by 2035.

Even products that involve an upfront cost can yield savings over the life of the investment. For example, the initial cost of insulating a home can pay for itself in a few years because of lower utility bills. The EPA estimates that homeowners can save an average of 15% on heating and cooling costs, or an average of 11% on total energy costs, by sealing and insulating their homes.

The Next Frontier in Sustainable Housing

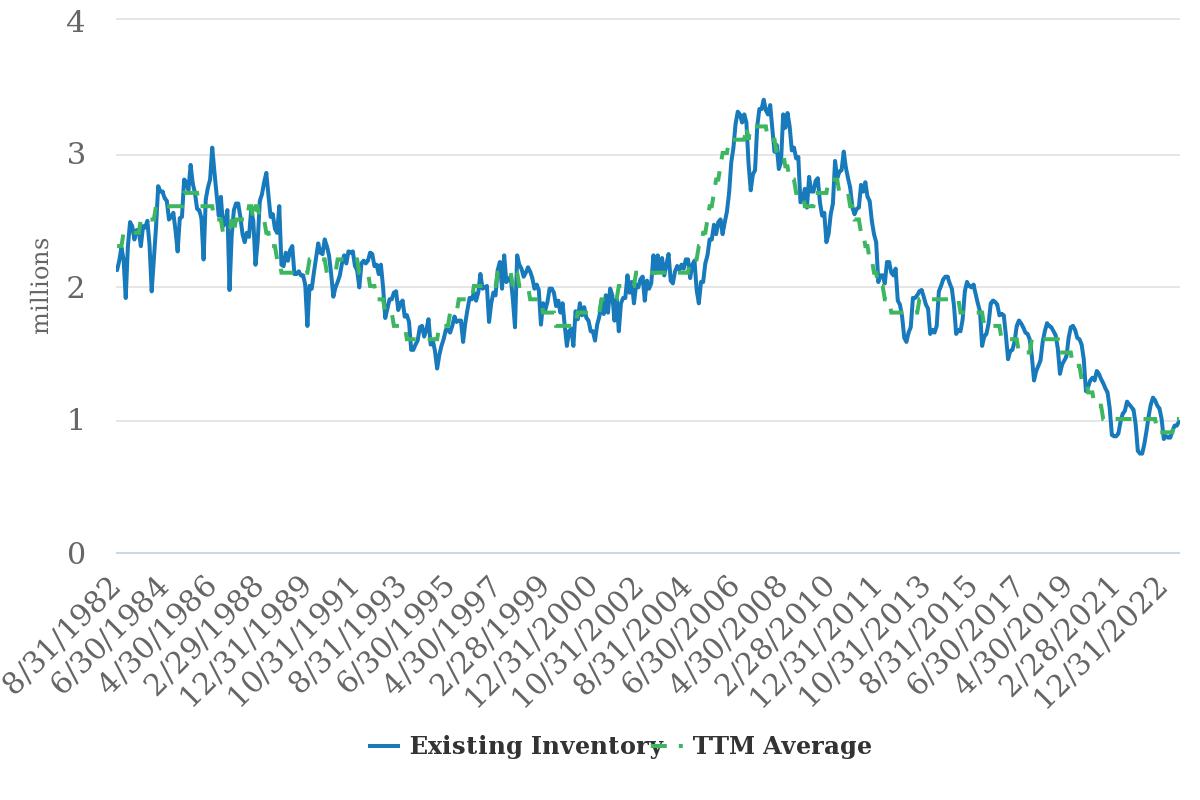

The drive for greener building standards can raise the cost of homes, putting them out of reach for large parts of the population. Already, increases in house prices and mortgage rates, combined with supply constraints, have meant affordability is at its worst levels since the 2007-08 global financial crisis. This environment disproportionately affects people based on race and ethnicity, age, socioeconomic status and other factors.

“So far, equity investment opportunities around the construction of social housing remains hard to find, but we think concerns about housing affordability should ultimately spur the government to implement policy aimed at supporting supply,” Sanchez says.

For full insights on the housing-market cycle and sustainable investment opportunities, ask your Morgan Stanley representative or Financial Advisor for the full reports, “Investing in the Current U.S. Housing Market Through a Sustainable Lens” (July 26, 2023) and “Navigating a Different Housing Cycle,” (July 17, 2023).